Introducing ARTH Loans — Interest-free liquidity

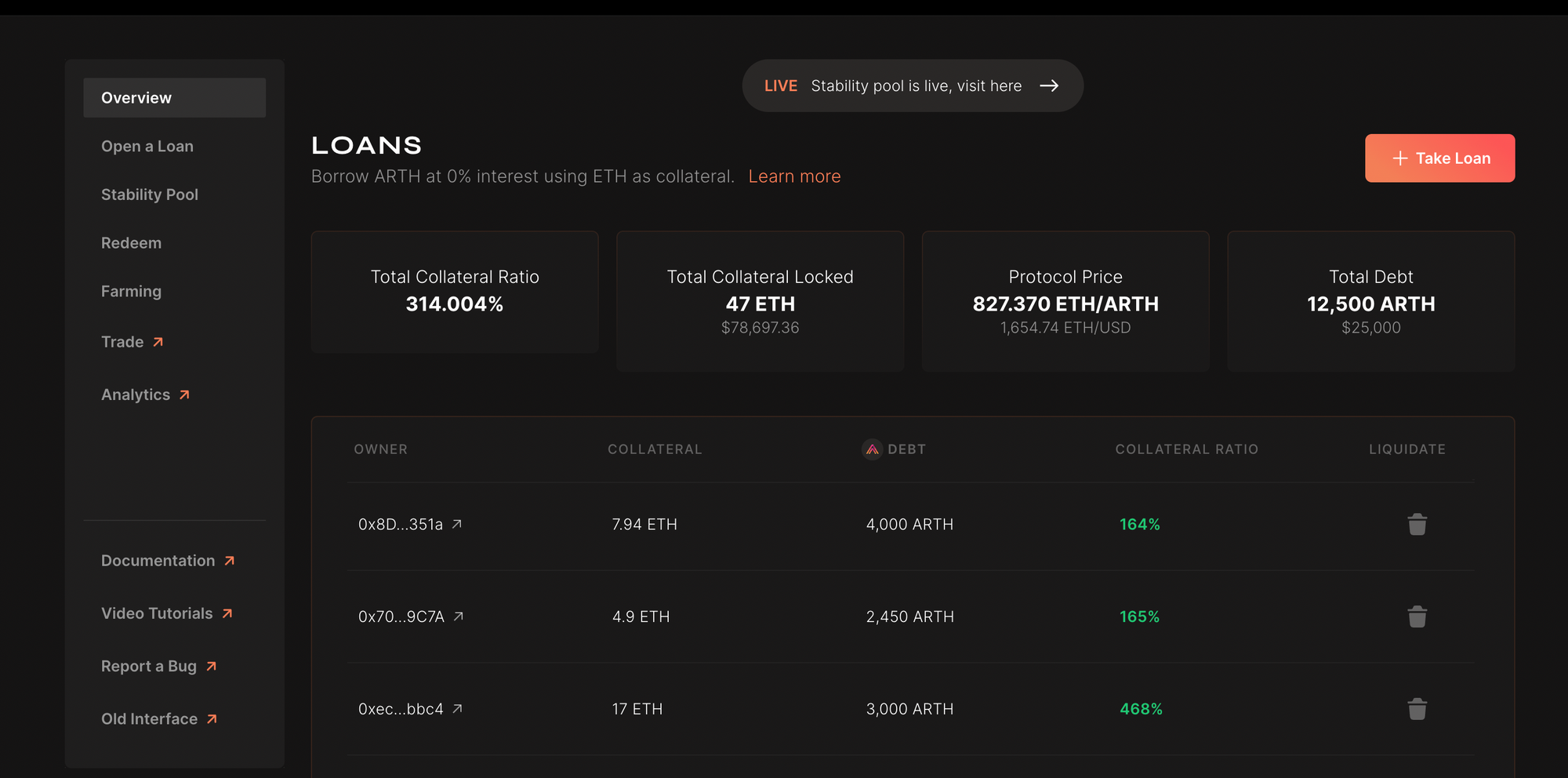

With ARTH Loans, borrowers can borrow ARTH at 0% interest and take on leverage with multiple crypto assets. It allows users to mint ARTH by putting down collateral, similar to how MakerDAO vaults work.

The ARTH Loans platform is one of the most exciting and upcoming products the team would like to introduce. We share features, details, and risks for what it means for ARTH and MAHA holders.

With ARTH Loans, borrowers can borrow ARTH at 0% interest and take on leverage with multiple crypto assets. It allows users to mint ARTH by putting down collateral, similar to how MakerDAO vaults work.

This allows ARTH to massively scale its market cap at a much lower risk than the current protocol and further expands the use case of ARTH as a lending and borrowing token.

ARTH Loans: Use-cases

- Taking on leveraged exposure with volatile assets. Users can get access to leverage and get exposure to crypto assets that don't have instruments for leverage.

- Inflation-proof & Interest-free loans; Borrowers don’t have to pay an annual interest fee when they borrow ARTH tokens. Furthermore, the loan they’ll be taking out will be inflation-proof since the loans will be in ARTH, which is pegged to the Global Measurement Unit (GMU).

- Placing a stop-loss for volatile assets; By opening a loan at a 110%+CR users can take a loan in ARTH tokens. Should the value of the collateral drop to a level where the position does get liquidated, the borrower won’t lose his borrowed ARTH which would be redeemable at 2$. Hence the borrowed ARTH acts as a stop loss for the underlying collateral.

- Acquiring volatile assets at a cheaper price by depositing ARTH into the Stability pool; The Stability pool is a pool used to perform liquidations and slowly pays back the depositors in the collateral token.

Leverage with volatile crypto assets (coming soon)

Taking leverage for volatile crypto-assets is one of the most disruptive features of the ARTH Loans platform. It allows users to have increased exposure to assets that would otherwise not be tradable with leverage on margin exchanges.

Users can take leverage up to 5x depending on how much liquidity is available for the collateral token in the various DEX pools.

The MahaDAO team will be actively partnering and listing assets that can be used as collateral within the ARTH loans platform. The team believes that this is where new demand and volume would come from for the ARTH token.

New arenas for generating Protocol Fees

As the second product from the MahaDAO team, ARTH loans will also have new ways to generate more protocol fees.

- Revenue from Liquidation: Every liquidation that occurs on the platform generates revenue. If a position falls below the minimum collateral ratio (of 110%), say 109%, then the liquidator sells off 100%, and 9% is profit. This 9% is split between the liquidator and the protocol as fees.

- Revenue from Borrowing: The protocol charges a 0.5% one-time transaction fee for borrowers who deposit collateral.

All fees generated will be distributed back to ARTHX holders, the developers, and to pay off the outstanding debt collected by debt pools.

For ARTH and MAHA token holders

The ARTH loans platform brings benefits to all three token holders.

- ARTH Holders: Will enjoy a more liquid ARTH token, get access to leverage on volatile crypto assets like ETH, and perform arbitrage with ARTH across the various pairs that will soon go live following the launch of ARTH loans.

- MAHA Holders: Will face short-term deflationary pressure as users who redeem ARTH tokens will have to pay a 1% stability fee in MAHA. MAHA holders will also be responsible for the governance of the various parameters in the platform (such as the stability fees and governing the target price of ARTH).

Risks Involved with ARTH Loans

Whilst the team ensured that the protocol is as low risk as possible for liquidity providers, there are still a few risks to consider when using the ARTH loans platform. In this section, we describe what those risks are and how we address them.

- Risks of being liquidated: For loans that have a collateral ratio that falls below the 110% threshold, the borrower faces the risk of being liquidated. This means that the borrower faces a net 10% loss upon liquidation. This loss is further exaggerated if the borrower decides to take on leverage. To prevent this, the team will be actively encouraging users to maintain a CR of at least 150%.

- Risk of being redeemed against: When users try to redeem against a vault for the underlying collateral, they will do so against the loans that are least under-collateralized first. This means that borrowers of those loans will not face a net loss, but will face a reduced exposure to the collateral token. To prevent this, the team will be actively encouraging users to maintain a high CR than other loans and be safe from being redeemed against.

- Oracle attacks: The protocol will primarily use Chainlink for its oracles; however being dependent on one organisation fully in itself is an imminent risk of its own. This becomes more prevalent with L2 chains (like Polygon/BSC) where the number of oracle providers is even smaller. To prevent this, the team will actively be working on integrating with more oracle providers and also ensuring that the protocol enables support for future community-driven oracles.

- The collapse of a collateral asset: Choosing an asset to be used for collateral exposes the protocol to the risks of that asset. Collapsing a collateral asset would imply a net loss to all the borrowers. To reduce this risk, the team will ensure strict conditions when listing assets that can be used as collateral and set limits on how much collateral can be collected by the protocol.

- Smart-Contract attacks or bugs/Economic exploits: Because the protocol is new and different from existing protocols, there is always the risk of an unforeseen bug or an economic exploit that causes the protocol to collapse and cause a net loss to all users. To reduce this risk, the team will actively seek audits for the code and keep bug bounties open for any such vulnerabilities that get exposed.

Conclusion

Now that the ARTH protocol has achieved stability, it is time to scale up. ⏫

Disclaimer — Leverage Trading

Trading with leverage is VERY SPECULATIVE AND HIGHLY RISKY and is not suitable for all members of the general public but only for those investors who: (a) understand and are willing to assume the economic, legal, and other risks involved. (b) taking into account their personal financial circumstances, financial resources, lifestyle, and obligations, are financially able to assume the loss of their entire investment. © have the knowledge to understand leverage trading and the Underlying assets and Markets. MahaDAO will not provide the user with any advice relating to leverage, the Underlying Assets, and Markets or make investment recommendations of any kind. So, if the user does not understand the risks involved he should seek advice and consultation from an independent financial advisor. If the user still does not understand the risks involved in trading in leverage, he should not trade at all. Trading crypto on leverage carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to participate in any kind of leverage you should carefully consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, or other financial instruments or services.

About MahaDAO

MahaDAO is a community-powered, decentralised autonomous organisation on a mission to empower billions to preserve their purchasing power through the world’s first valuecoin, ARTH.

MahaDAO Official Links

Telegram | Twitter | Discord | Github| Website | Governance Portal | Discussion Forum | Gitbook | Product